Your Gateway To Global Discoveries

The SWIFT BIC code for Novo is NOVOBV21

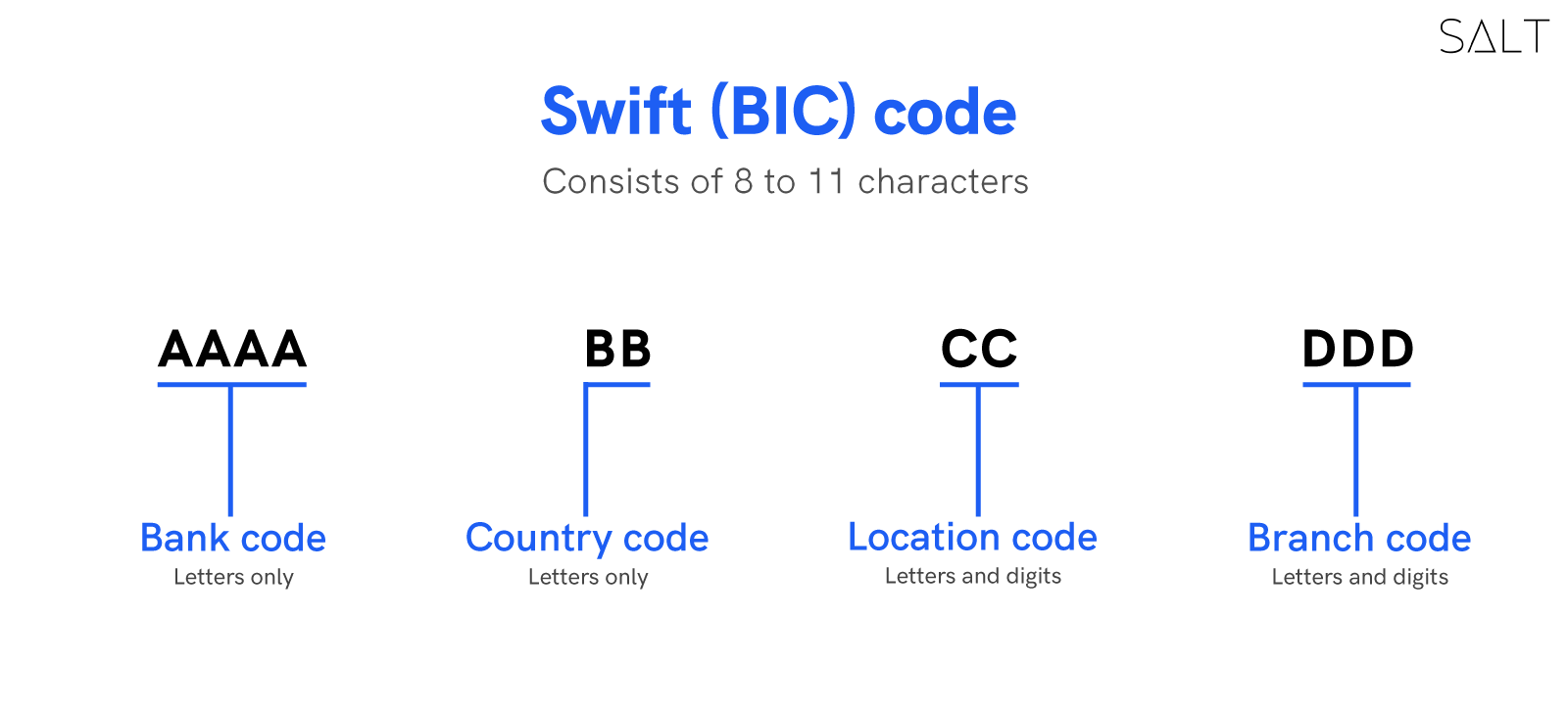

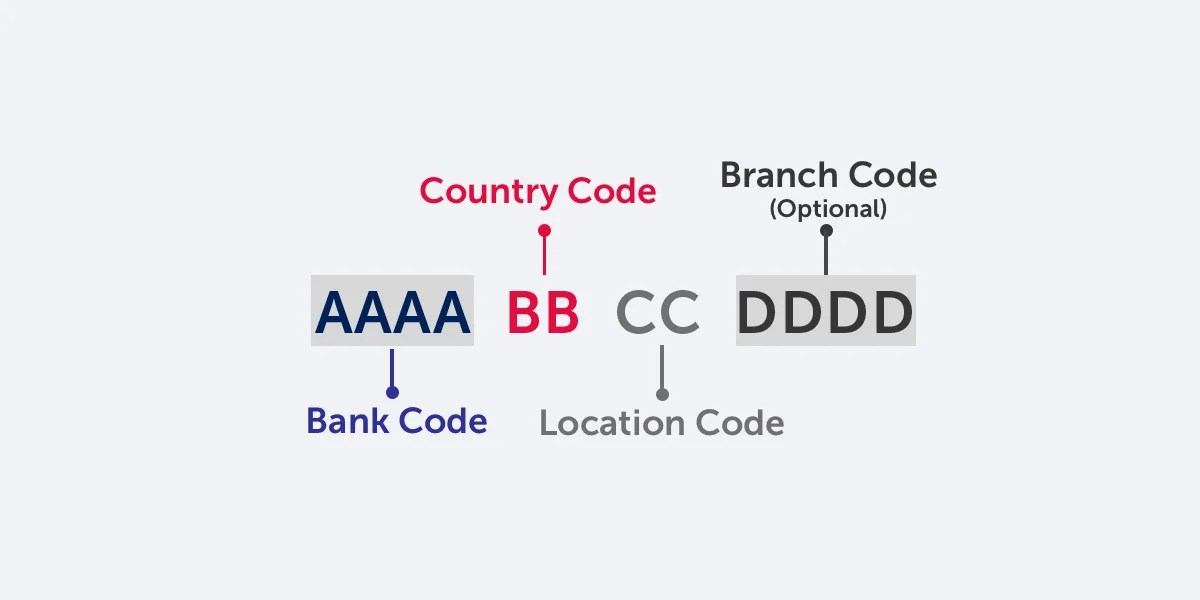

A SWIFT BIC, or Bank Identifier Code, is a unique code used to identify a specific bank or branch. It is used in international wire transfers to ensure that the money is sent to the correct account. The SWIFT BIC for Novo is NOVOBV21, which is used to identify Novo's main branch in New York City.

Using the correct SWIFT BIC is important to ensure that your international wire transfer is processed quickly and accurately. If you are sending money to Novo, be sure to use the SWIFT BIC NOVOBV21 to avoid any delays or errors.

SWIFT BIC code for Novo

The SWIFT BIC code for Novo is NOVOBV21. This code is used to identify Novo's main branch in New York City when sending international wire transfers.

- Bank: Novo

- SWIFT BIC: NOVOBV21

- Branch: New York City

- Country: United States

- Currency: US Dollar

- Transfer Type: International wire transfer

- Purpose: To send money to a Novo account from another country

- Fees: May vary depending on the sending and receiving banks

When sending an international wire transfer to Novo, it is important to use the correct SWIFT BIC code to ensure that the money is sent to the correct account. If the incorrect SWIFT BIC code is used, the transfer may be delayed or even lost.

In addition to the SWIFT BIC code, you will also need to provide the following information when sending an international wire transfer to Novo:

- The recipient's name

- The recipient's account number

- The amount of money you are sending

- The currency you are sending the money in

Bank

The SWIFT BIC code for Novo is NOVOBV21. This code is used to identify Novo's main branch in New York City when sending international wire transfers. The SWIFT BIC code is a unique identifier for each bank and branch, and it is used to ensure that international wire transfers are sent to the correct account.

When sending an international wire transfer to Novo, it is important to use the correct SWIFT BIC code. If the incorrect SWIFT BIC code is used, the transfer may be delayed or even lost. In addition to the SWIFT BIC code, you will also need to provide the following information when sending an international wire transfer to Novo:

- The recipient's name

- The recipient's account number

- The amount of money you are sending

- The currency you are sending the money in

Once you have provided all of the necessary information, your international wire transfer will be processed and the money will be sent to the recipient's Novo account.

Understanding the connection between "Bank: Novo" and "SWIFT BIC code for Novo" is important for businesses and individuals who need to send international wire transfers to Novo. By using the correct SWIFT BIC code, you can ensure that your transfer is processed quickly and accurately.

SWIFT BIC

The SWIFT BIC code for Novo is NOVOBV21. This code is used to identify Novo's main branch in New York City when sending international wire transfers. The SWIFT BIC code is a unique identifier for each bank and branch, and it is used to ensure that international wire transfers are sent to the correct account.

The SWIFT BIC code is an important part of the international wire transfer process. Without the correct SWIFT BIC code, the transfer may be delayed or even lost. Therefore, it is important to use the correct SWIFT BIC code when sending an international wire transfer to Novo.

Here are some examples of how the SWIFT BIC code is used in international wire transfers:

- When you send an international wire transfer from your bank account to a Novo account, you will need to provide the SWIFT BIC code for Novo.

- When you receive an international wire transfer from a Novo account to your bank account, the sender will need to provide the SWIFT BIC code for Novo.

By understanding the connection between "SWIFT BIC: NOVOBV21" and "swift bic code for novo", you can ensure that your international wire transfers are processed quickly and accurately.

Branch

The SWIFT BIC code for Novo is NOVOBV21, which is used to identify Novo's main branch in New York City. The SWIFT BIC code is a unique identifier for each bank and branch, and it is used to ensure that international wire transfers are sent to the correct account.

The branch location is an important part of the SWIFT BIC code because it helps to identify the specific branch that is handling the international wire transfer. This is important because different branches of the same bank may have different SWIFT BIC codes. For example, Novo has multiple branches in different countries, and each branch has its own unique SWIFT BIC code.

When sending an international wire transfer to Novo, it is important to use the correct SWIFT BIC code for the branch that is handling the transfer. If the incorrect SWIFT BIC code is used, the transfer may be delayed or even lost.

Here are some examples of how the branch location is connected to the SWIFT BIC code for Novo:

- If you are sending an international wire transfer to Novo's main branch in New York City, you will need to use the SWIFT BIC code NOVOBV21.

- If you are sending an international wire transfer to Novo's branch in London, you will need to use the SWIFT BIC code NOVO GB2L.

- If you are sending an international wire transfer to Novo's branch in Toronto, you will need to use the SWIFT BIC code NOVO CA2T.

By understanding the connection between "Branch: New York City" and "swift bic code for novo", you can ensure that your international wire transfers are processed quickly and accurately.

Country

The SWIFT BIC code for Novo is NOVOBV21, which is used to identify Novo's main branch in New York City, United States. The country in which a bank is located is an important part of the SWIFT BIC code because it helps to identify the specific country that is handling the international wire transfer.

- Regulatory Compliance: Each country has its own set of banking regulations and compliance requirements. By understanding the country associated with the SWIFT BIC code, businesses and individuals can ensure that their international wire transfers are compliant with all applicable laws and regulations.

- Currency Exchange Rates: The country in which a bank is located can also impact the currency exchange rates that are applied to international wire transfers. By being aware of the country associated with the SWIFT BIC code, businesses and individuals can factor in any potential currency exchange rate fluctuations when sending or receiving international wire transfers.

- Time Zones and Business Hours: The country in which a bank is located can also impact the time zones and business hours that are applicable to international wire transfers. By understanding the country associated with the SWIFT BIC code, businesses and individuals can ensure that their international wire transfers are sent and received during the appropriate business hours.

- Customer Support: In the event that there is a problem with an international wire transfer, businesses and individuals may need to contact the bank's customer support team. By understanding the country associated with the SWIFT BIC code, businesses and individuals can ensure that they are able to contact the bank's customer support team in a timely and efficient manner.

By understanding the connection between "Country: United States" and "swift bic code for novo", businesses and individuals can ensure that their international wire transfers are processed quickly, accurately, and in compliance with all applicable laws and regulations.

Currency

The SWIFT BIC code for Novo is NOVOBV21, which is used to identify Novo's main branch in New York City, United States. The currency used by a bank is an important part of the SWIFT BIC code because it helps to identify the specific currency that is being used for the international wire transfer.

- International Transactions: The US Dollar is one of the most widely used currencies in the world, making it a popular choice for international wire transfers. By understanding the currency associated with the SWIFT BIC code, businesses and individuals can ensure that their international wire transfers are processed in the correct currency.

- Currency Exchange Rates: The currency used by a bank can also impact the currency exchange rates that are applied to international wire transfers. By being aware of the currency associated with the SWIFT BIC code, businesses and individuals can factor in any potential currency exchange rate fluctuations when sending or receiving international wire transfers.

- Compliance and Regulations: Different countries have different banking regulations and compliance requirements. By understanding the currency associated with the SWIFT BIC code, businesses and individuals can ensure that their international wire transfers are compliant with all applicable laws and regulations.

- Customer Support: In the event that there is a problem with an international wire transfer, businesses and individuals may need to contact the bank's customer support team. By understanding the currency associated with the SWIFT BIC code, businesses and individuals can ensure that they are able to contact the bank's customer support team in a timely and efficient manner.

By understanding the connection between "Currency: US Dollar" and "swift bic code for novo", businesses and individuals can ensure that their international wire transfers are processed quickly, accurately, and in compliance with all applicable laws and regulations.

Transfer Type

The SWIFT BIC code for Novo is NOVOBV21, which is used to identify Novo's main branch in New York City, United States. The transfer type associated with the SWIFT BIC code is international wire transfer, which is an electronic transfer of funds from one country to another.

International wire transfers are typically used to send money to family and friends overseas, to make business payments, or to purchase goods and services from foreign countries. When sending an international wire transfer, it is important to use the correct SWIFT BIC code to ensure that the money is sent to the correct account.

The SWIFT BIC code is a unique identifier for each bank and branch, and it is used to ensure that international wire transfers are processed quickly and accurately. Without the correct SWIFT BIC code, the transfer may be delayed or even lost.

Here are some examples of how the transfer type is connected to the SWIFT BIC code for Novo:

- When you send an international wire transfer from your bank account to a Novo account, you will need to provide the SWIFT BIC code for Novo.

- When you receive an international wire transfer from a Novo account to your bank account, the sender will need to provide the SWIFT BIC code for Novo.

By understanding the connection between "Transfer Type: International wire transfer" and "swift bic code for novo", you can ensure that your international wire transfers are processed quickly and accurately.

Purpose

The SWIFT BIC code for Novo is NOVOBV21, which is used to identify Novo's main branch in New York City, United States. The purpose of using the SWIFT BIC code is to ensure that international wire transfers are sent to the correct account.

When sending money to a Novo account from another country, it is important to use the correct SWIFT BIC code. If the incorrect SWIFT BIC code is used, the transfer may be delayed or even lost. Therefore, it is important to double-check the SWIFT BIC code before sending an international wire transfer.

Here are some examples of how the purpose of sending money to a Novo account from another country is connected to the SWIFT BIC code:

- When you send money to a Novo account from your bank account in another country, you will need to provide the SWIFT BIC code for Novo.

- When you receive money from a Novo account in your bank account in another country, the sender will need to provide the SWIFT BIC code for Novo.

By understanding the connection between "Purpose: To send money to a Novo account from another country" and "swift bic code for novo", you can ensure that your international wire transfers are processed quickly and accurately.

Fees

When sending an international wire transfer to a Novo account, it is important to be aware that fees may vary depending on the sending and receiving banks. These fees can include a sending fee, a receiving fee, and an intermediary bank fee. The sending fee is charged by the bank that is sending the wire transfer, and the receiving fee is charged by the bank that is receiving the wire transfer. The intermediary bank fee is charged by the bank that facilitates the transfer between the sending and receiving banks.

The amount of the fees will vary depending on the banks involved and the amount of money being sent. However, it is important to factor these fees into the cost of sending an international wire transfer. If you are sending a large amount of money, it is important to compare the fees charged by different banks before choosing a bank to send the transfer through.

The SWIFT BIC code is an important part of the international wire transfer process. It is used to identify the bank that is sending the wire transfer and the bank that is receiving the wire transfer. By understanding the connection between "Fees: May vary depending on the sending and receiving banks" and "swift bic code for novo", you can ensure that your international wire transfers are processed quickly, accurately, and at the lowest possible cost.

The recipient's name

The recipient's name is an important part of the international wire transfer process. It is used to identify the person or organization that is receiving the wire transfer. The recipient's name must match the name on the account that is receiving the wire transfer. If the recipient's name does not match the name on the account, the transfer may be delayed or even lost.

- Accuracy: The recipient's name must be accurate in order for the wire transfer to be processed correctly. Any errors in the recipient's name may cause the transfer to be delayed or lost.

- Matching: The recipient's name must match the name on the account that is receiving the wire transfer. If the names do not match, the transfer may be delayed or lost.

- Verification: The recipient's name should be verified before sending the wire transfer. This can be done by contacting the recipient and confirming their name and account information.

- Importance: The recipient's name is an important part of the international wire transfer process. By ensuring that the recipient's name is accurate and matches the name on the account, you can help to ensure that the wire transfer is processed quickly and accurately.

The SWIFT BIC code is an important part of the international wire transfer process. It is used to identify the bank that is sending the wire transfer and the bank that is receiving the wire transfer. The recipient's name is also an important part of the international wire transfer process. It is used to identify the person or organization that is receiving the wire transfer.

The recipient's account number

When sending an international wire transfer to a Novo account, it is important to provide the recipient's account number. The recipient's account number is a unique identifier for the account that is receiving the wire transfer. It is important to ensure that the recipient's account number is correct in order for the wire transfer to be processed successfully.

- Accuracy: The recipient's account number must be accurate in order for the wire transfer to be processed correctly. Any errors in the recipient's account number may cause the transfer to be delayed or even lost.

- Matching: The recipient's account number must match the account number on the account that is receiving the wire transfer. If the account numbers do not match, the transfer may be delayed or lost.

- Verification: The recipient's account number should be verified before sending the wire transfer. This can be done by contacting the recipient and confirming their account number.

- SWIFT BIC code: The recipient's account number is used in conjunction with the SWIFT BIC code to ensure that the wire transfer is sent to the correct account. The SWIFT BIC code identifies the bank that is receiving the wire transfer.

By understanding the connection between "The recipient's account number" and "swift bic code for novo", you can ensure that your international wire transfers are processed quickly, accurately, and to the correct account.

The amount of money you are sending

The amount of money you are sending is an important factor to consider when using the SWIFT BIC code for Novo. The SWIFT BIC code is a unique identifier for each bank and branch, and it is used to ensure that international wire transfers are sent to the correct account. When sending a large amount of money, it is important to use the correct SWIFT BIC code to ensure that the money is sent to the correct account and that the transfer is processed quickly and accurately.

There are a few things to keep in mind when sending a large amount of money using the SWIFT BIC code for Novo. First, you should always verify the SWIFT BIC code with the recipient before sending the transfer. This will help to ensure that the money is sent to the correct account. Second, you should be aware of the fees associated with sending a large amount of money using the SWIFT BIC code for Novo. These fees can vary depending on the amount of money being sent and the bank that is sending the transfer. Finally, you should be aware of the time it takes for a large amount of money to be transferred using the SWIFT BIC code for Novo. This can vary depending on the bank that is sending the transfer and the bank that is receiving the transfer.

By understanding the connection between "The amount of money you are sending" and "swift bic code for novo", you can ensure that your international wire transfers are processed quickly, accurately, and to the correct account.The currency you are sending the money in

The currency you are sending the money in is an important factor to consider when using the SWIFT BIC code for Novo. The SWIFT BIC code is a unique identifier for each bank and branch, and it is used to ensure that international wire transfers are sent to the correct account. When sending money to a Novo account, it is important to use the correct SWIFT BIC code and to specify the currency that you are sending the money in.

There are a few things to keep in mind when sending money in a foreign currency using the SWIFT BIC code for Novo. First, you should be aware of the exchange rate between the currency you are sending the money in and the currency of the recipient's account. The exchange rate will determine how much money the recipient will receive. Second, you should be aware of any fees that may be associated with sending money in a foreign currency. These fees can vary depending on the bank that you are sending the money from and the bank that the recipient's account is with.

By understanding the connection between "The currency you are sending the money in" and "swift bic code for novo", you can ensure that your international wire transfers are processed quickly, accurately, and to the correct account.

FAQs on SWIFT BIC Code for Novo

The SWIFT BIC code, also known as the Bank Identifier Code, is a unique identifier for banks and financial institutions worldwide. It plays a crucial role in facilitating international wire transfers by ensuring that funds are sent to the correct recipient account.

Question 1: What is the SWIFT BIC code for Novo?

The SWIFT BIC code for Novo is NOVOBV21. This code identifies Novo's main branch in New York City.

Question 2: Why is using the correct SWIFT BIC code important?

Using the correct SWIFT BIC code is essential to ensure that your international wire transfer is sent to the intended recipient's account. An incorrect SWIFT BIC code may result in delays or even loss of funds.

Question 3: What information do I need to provide for an international wire transfer to Novo?

In addition to the SWIFT BIC code, you will need to provide the recipient's name, account number, the amount you wish to transfer, and the currency.

Question 4: Are there any fees associated with using the SWIFT network?

Yes, there may be fees charged by both the sending and receiving banks for using the SWIFT network. These fees can vary depending on the amount transferred and the banks involved.

Question 5: How long does it take for an international wire transfer to Novo to be processed?

Processing times for international wire transfers can vary, but typically take 1-5 business days depending on the banks involved and the destination country.

Question 6: What should I do if I encounter any issues with my international wire transfer?

If you experience any issues or delays with your wire transfer, you should contact your bank or Novo's customer support for assistance.

By understanding the importance and usage of the SWIFT BIC code for Novo, you can ensure that your international wire transfers are processed smoothly and efficiently.

To learn more about international wire transfers and the SWIFT network, please refer to the next article section.

Tips on Using SWIFT BIC Code for Novo

To ensure smooth and efficient international wire transfers to Novo accounts, consider the following tips:

Tip 1: Double-Check the SWIFT BIC Code

Confirm the accuracy of the SWIFT BIC code (NOVOBV21) before initiating the wire transfer. Verify it with Novo or a reliable source to avoid potential delays or errors.

Tip 2: Provide Complete Recipient Information

Ensure you have the recipient's full name, account number, and the amount to be transferred. This information is crucial for the funds to be credited to the correct account.

Tip 3: Specify the Currency

Clearly indicate the currency of the wire transfer to avoid any confusion or incorrect currency conversions. This ensures the intended amount is received by the recipient.

Tip 4: Be Aware of Fees

Inquire about any applicable fees charged by both the sending and receiving banks for using the SWIFT network. These fees may vary depending on the transaction amount and the banks involved.

Tip 5: Track Your Transfer

Keep a record of the transaction reference number or any tracking information provided by your bank. This will allow you to monitor the progress of your wire transfer and contact your bank if necessary.

Summary:

By following these tips and using the correct SWIFT BIC code (NOVOBV21), you can increase the accuracy, efficiency, and security of your international wire transfers to Novo accounts.

Conclusion

The SWIFT BIC code, specifically NOVOBV21 for Novo, plays a vital role in facilitating secure and efficient international wire transfers. Understanding the importance and proper usage of this code ensures that funds are sent accurately and promptly to Novo accounts.

By adhering to the tips outlined in this article, businesses and individuals can minimize errors, avoid delays, and ensure the smooth processing of their international wire transfers. Embracing the SWIFT network and utilizing the correct BIC code empowers seamless global financial transactions.

ncG1vNJzZmian6Kvpn2YZ6psZqWoerix0q1ka2aRoq67u82arqxmk6S6cLLOnKysZ6OstqfAjJugnGWTpLGmecWoqWamn6u8b7TTpqM%3D